Tech services giant Computer Sciences Corp. (CSC), in the midst of splitting itself in two, just announced two "tuck-in" acquisitions.

One is Fruition Partners, which CSC describes as the largest ServiceNow-exclusive service management consulting firm. Fruition Partners is based in Chicago and does business in the United States, Canada, the U.K. and South America. The company brings 300 ServiceNow practitioners and 800 clients to CSC. Fruition Partners will become part of CSC's Global Enterprise Solutions Consulting Group, and beef up CSC's ServiceNow practice, while joining other practices, including SAP, Oracle, Workday and Salesforce.

The other of the two deals announced Tuesday is for Fixnetix. London-based Fixnetix bills itself as a managed services provider to financial companies, providing a high-efficiency trading appliance and 40 co-location and proximity hosting centers worldwide for mission-critical trading systems.

Terms of the deals were not disclosed. CSC President, CEO and Director Mike Lawrie said in an investor call that the company's schedule requires closing the deals in September or October.

The announcements came as the 70,000-employee CSC released financial results for the first quarter of its fiscal year 2016. Earnings rose nearly 10 percent to $160 million on a 15 percent drop in revenues to $2.76 billion. Those results beat analysts' expectations on profits but missed on revenues.

Falls Church, Va.-based CSC plans to separate into two companies later this year -- a commercial business and a North American public sector business.

In response to analyst questions during the earnings call, Lawrie provided some context about this week's acquisitions, as well as possible future deals.

"These businesses that we bought today are what I'd classify...as tuck-ins. These aren't huge acquisitions by any stretch of the imagination. But they're examples of new offerings that we think can grow fairly rapidly over this period of time and help shrink that gap between our traditional business and these new businesses," said Lawrie, according to a Seeking Alpha transcript of the call.

Lawrie also hinted at a possibility that CSC's public sector business might be acquired after the separation is complete. "I think once we separate the business, obviously, it's a publicly traded company, so it's going to take advantage of opportunities both as an acquirer or as an acquiree," Lawrie said. "I do think the general landscape in the federal government business will be consolidation over time."

Posted by Scott Bekker on August 12, 20150 comments

Attempting to quantify what it's been preaching for the last few years, Microsoft published some internal research numbers on what partners spend on managed-services employees versus project-services employees.

Project-services employees cost about 17 percent more on average than managed-services employees, according to Microsoft.

As Microsoft moves its products to the cloud, the company's channel-facing executives have been urging partners to transform their businesses from the project-services approach that has worked so well for the channel in the days of Exchange migration projects and SharePoint implementations. Now, Microsoft wants partners who offer managed services to their customers that bundle things like Office 365, Dynamics CRM Online, Azure services.

One of the arguments is that managed-services employees, with a heavier help-desk orientation, are less expensive to hire and employ than the project-services experts who can design or implement comprehensive solutions.

Microsoft released some data on pay as part of a huge recent data dump on cloud opportunities and business models. (See Barb Levisay's recent coverage here.)

The data came from 1,260 surveys in March through April of this year of English-speaking members of the Microsoft Partner Research Panel. Due to currency adjustments and wide geographic differences, the figures themselves are too broad to be too meaningful, but the percentage differences are instructive.

[Click on image for larger view.]

[Click on image for larger view.]

According to the survey, average annual spend on one project-services employee is $54,350. That's 17 percent higher than the average annual spend of $46,430 on a managed-services employee. See the chart on this page from the Microsoft report, "Microsoft Cloud Profitability Scenarios," for more detail, such as breakdowns for partners serving SMB versus enterprise customers, and for sales and marketing employee details. The SMB customer-focused partners spending per employees is 13 percent higher for project services versus managed services, while the enterprise premium is 15 percent.

This is just one example of the reams of information Microsoft provided in the recent data dump. The whole data set is well worth checking out here and here.

Posted by Scott Bekker on August 10, 20150 comments

Microsoft this week laid out some of its partner enablement efforts surrounding Windows 10, including the inclusion of Windows 10 Internal Use Rights into the Action Pack and competency license grants.

"We know that partners who exercise their Internal Use Rights (IURs) sell more because they're often more knowledgeable about and comfortable with the solutions they're selling. We want all our partners to feel comfortable with Windows 10, so we've made the Windows 10 Enterprise upgrade available to all Action Pack and Competency partners," said Gavriella Schuster, general manager of the Microsoft Partner Network (MPN), in a blog post.

The update to the Action Pack and the competencies was announced this week, following the general availability of Windows 10 on July 29, and the volume licensing availability of the new operating system on Aug. 1. The IURs are available on Microsoft's partner download portal here (password protected).

Partners can qualify for the Action Pack, if they confirm to Microsoft that they sell more than 75 percent of their products and services to customers outside their own company, among other restrictions. The $475-per-year subscription gets a partner enough client and server software licenses and cloud seats to run a 10-person business. The Action Pack includes 10 upgrade licenses to Windows 10 Enterprise edition.

Competency partners also get IURs. In the case of Windows 10, partners with a Silver competency can use 25 licenses, while Gold competency partners are entitled to 100 licenses. Those programs are more expensive to join than the Action Pack and carry revenue commitments and heavier training requirements.

The IUR move also gives partners the ability to use the most functional version of Windows 10, the Enterprise Edition, a volume licensing OS which includes a number of business-friendly features not available in other versions.

The Enterprise Editions of Windows 7, 8.1 and 10 aren't part of the high-profile, free upgrade from Windows 7 or Windows 8.1. Under that free program, current users of Windows 7 Starter, Windows 7 Home Basic, Windows 7 Home Premium, Windows 8.1 and Windows 8.1 with Bing can upgrade to Windows 10 Home. Users of Windows 7 Professional, Windows 7 Ultimate and Windows 8.1 Pro are eligible for the free update to Windows 10 Pro.

Meanwhile, Microsoft will also push partners forward with the IUR update in the Action Pack and competencies. The IURs do not include the downgrade rights to older versions of Windows that are allowed in other types of Microsoft licenses.

Schuster also urged partners to encourage their customers to take advantage of the 90-day Windows 10 Enterprise Evaluation to start getting familiar with the operating system and plan their deployments.

Posted by Scott Bekker on August 06, 20150 comments

Microsoft on Monday acquired a company with a gamification platform for motivating sales teams through robust contests. It also disclosed plans to bring the platform first into Dynamics CRM and eventually into more Dynamics products.

Terms of the deal to acquire Incent Games Inc., the Austin, Texas-based maker of FantasySalesTeam, were not disclosed.

FantasySalesTeam combines sales contests with fantasy sports league concepts to help sales managers generate contests that allow non-salespeople to get engaged and draft teams of salespeople who score points for the team via multiple metrics.

"While incentive programs and contests are leveraged in almost all sales organizations, most suffer from common shortcomings: the same top performers almost always win and the rest of the team tends to disengage fairly quickly once they realize they've fallen behind or out of contention," wrote Bob Stutz, corporate vice president of Microsoft Dynamics CRM, in a blog post announcing the acquisition. "FantasySalesTeam creatively addresses these problems with a tailored approach that drives amazing results."

The gamification application currently has hundreds of customers, including Service Corporation International and Wireless Zone.

"We believe that motivating users of Dynamics CRM to focus on their most important metrics while simultaneously increasing usage and adoption can help drive tremendous impact on our customer's success," Stutz said.

He said integration with Dynamics CRM would occur in the coming months. While promising to continue to support FantasySalesTeam customers on other CRM platforms, Stutz sketched general plans to integrate and evolve FantasySalesTeam into the other parts of the Dynamics ecosystem.

In a separate blog post, Incent Games CEO Adam Hollander said, "This acquisition is a testament to the power of gamification when designed and implemented the right way."

Posted by Scott Bekker on August 03, 20150 comments

Microsoft gave partners a lot to chew on last week during its Worldwide Partner Conference (WPC). Here's a recap of the major themes of the show through 11 notable quotes by Microsoft executives that highlight implications and opportunities that will reverberate through the channel for Microsoft's fiscal 2016.

***

"I hope you realize this is the single biggest investment we're making in expanding our channel for cloud, and we hope you participate with us."

"I hope you realize this is the single biggest investment we're making in expanding our channel for cloud, and we hope you participate with us."

--John Case, Corporate Vice President, Microsoft Office

It would be impossible to overstate what a big deal Cloud Solution Provider (CSP) is going to be over the next year. Although it got a soft launch a year ago, CSP had its real debutante's ball at the Orlando WPC last week. The amount of support in the vendor community is impressive, with companies like Odin, AppDirect, Tech Data and Ingram Micro making serious pushes to enable broad partner participation in CSP. Many of the Office 365 syndication partners are all-in already, as well.

For many Microsoft solution providers, CSP is the cloud program they've been asking Microsoft to provide since about 2009. The partner can control the customer billing, unlike the Advisor model, and the partner pays for the seats on a monthly basis just like the customer, unlike with Open.

For more detail on CSP, see RCP's July cover story.

***

"As a community, it's important for us to have, I think, a conversation this morning about this: What's going on around the world when it comes to this issue of trust? What do the events of the last year mean? And most importantly, what together can we do to advance the cause of ensuring that the world can trust the technology that is being created?"

"As a community, it's important for us to have, I think, a conversation this morning about this: What's going on around the world when it comes to this issue of trust? What do the events of the last year mean? And most importantly, what together can we do to advance the cause of ensuring that the world can trust the technology that is being created?"

--Brad Smith, General Counsel and Executive Vice President

The Snowden revelations have put major U.S.-based technology companies on their heels with consumers, business customers and governments, especially outside the United States. In his first WPC stage appearance, Smith, Microsoft's top lawyer, tackled the issues involved in a balanced speech that was well-received by the partner audience, which included a large contingent of non-U.S. partners. Going through specific examples that illustrate the tensions in Microsoft's responsibilities to governments, businesses and consumers, Smith laid out principles and commitments for Microsoft going forward. He also provided details about three Microsoft lawsuits against the U.S. government in the last two years.

***

"There is no other ecosystem that is primarily and solely built to help customers achieve greatness."

"There is no other ecosystem that is primarily and solely built to help customers achieve greatness."

--Satya Nadella, CEO

Nadella set a high bar for what distinguishes the Microsoft ecosystem from other partner programs. He spent much of his keynote explaining what Microsoft stands for. Some of the principles he set for Microsoft provided the foundation for Smith's speech later in the week.

***

"In Outlook 2016, there's a very cool feature that I love now, and it basically utilizes the 'most recently used' across Office right in your attach segment here. So if I click this, you can see these documents are right there that I just worked on." [Huge applause break.] "I know! It's crazy."

"In Outlook 2016, there's a very cool feature that I love now, and it basically utilizes the 'most recently used' across Office right in your attach segment here. So if I click this, you can see these documents are right there that I just worked on." [Huge applause break.] "I know! It's crazy."

--Bryan Roper, Executive Demo Lead at Microsoft

Roper was the breakout star of the WPC keynotes. In his hipster hat, Roper stole the show as the demo guy during Windows and Devices Group Executive Vice President Terry Myerson's keynote. Partners cheered highlight after highlight during Roper's detailed walkthrough of the best features of Windows 10 and Office 2016.

***

"There seems to have been some question about our commitment to SharePoint in the past year. ... [At the Ignite conference] I saw a lot of comments that said, 'I didn't hear a lot about SharePoint. Julia only said SharePoint a couple of times, what's that mean?' Today, I'm here to say, 'SharePoint. SharePoint, SharePoint, SharePoint, SharePoint, SharePoint!' We are absolutely committed. We have a fantastic SharePoint Server 2016 coming out."

"There seems to have been some question about our commitment to SharePoint in the past year. ... [At the Ignite conference] I saw a lot of comments that said, 'I didn't hear a lot about SharePoint. Julia only said SharePoint a couple of times, what's that mean?' Today, I'm here to say, 'SharePoint. SharePoint, SharePoint, SharePoint, SharePoint, SharePoint!' We are absolutely committed. We have a fantastic SharePoint Server 2016 coming out."

--Julia White, General Manager, Microsoft Office Division

White effectively put any doubts about Microsoft's commitment to on-premises SharePoint to rest with a flare reminiscent of Steve Ballmer's famous bit about "Developers! Developers! Developers!"

Specifically, White called out use of the same codebase for SharePoint on-premise as in the cloud, hybrid-optimization, data loss prevention, e-discovery and the ability to tap Office Graph cloud capabilities.

***

"And you know what, Microsoft has really big ambition for what we can achieve, and we have really big ambition for what you can achieve with us. And that last point is really important, because...92 percent of all Microsoft revenue is through our partner ecosystem versus 39 percent for the rest of the IT market."

"And you know what, Microsoft has really big ambition for what we can achieve, and we have really big ambition for what you can achieve with us. And that last point is really important, because...92 percent of all Microsoft revenue is through our partner ecosystem versus 39 percent for the rest of the IT market."

--Phil Sorgen, Corporate Vice President, Worldwide Partner Group

Sorgen quoted IDC figures tracking how much revenue in the industry goes through the channel versus direct. The percentage is lower than during the heyday of the late 2000s, when the quoted numbers for Microsoft were 95 percent or higher. Yet the number is still extremely respectable considering Microsoft's recent direct pushes with first-party hardware products. Meanwhile, the percentage now applies to much higher overall revenue numbers than it did back then.

***

"So I've gotten this request from many of you all year: We are eliminating the requirements to track unique MCPs per competency." [Applause break.] "I'm glad you like that -- and the tracking of sales assessments, so that we can focus more on the outcomes through your performance, which means I need to give you better ways to track your own performance."

"So I've gotten this request from many of you all year: We are eliminating the requirements to track unique MCPs per competency." [Applause break.] "I'm glad you like that -- and the tracking of sales assessments, so that we can focus more on the outcomes through your performance, which means I need to give you better ways to track your own performance."

--Gavriella Schuster, General Manager, Microsoft Partner Network.

Competencies have been a big deal since Microsoft transitioned the Microsoft Partner Program into the Microsoft Partner Network a few years ago. Microsoft seems to be de-emphasizing competencies now. The main competencies you hear about now are the four, soon to be five, cloud competencies. (The fifth, an Enterprise Mobility Suite competency, is slated for late September.) The CSP program will, in many ways, function as a new landing place for many partners, and, on the Azure side, certifications are bringing a new way for partners to declare hybrid solution expertise. The move to remove unique training MCP requirements unwinds much of the forced partner specialization that was engineered into the MPN competencies.

***

"So what Office 365 represents, what Dynamics represents, we want to bring these different products today into one set of services, which are extensible."

"So what Office 365 represents, what Dynamics represents, we want to bring these different products today into one set of services, which are extensible."

--Satya Nadella

The word "Dynamics" there in Nadella's keynote was significant. Many partners heard a new emphasis on Dynamics, both CRM and ERP, at WPC, and then again this week in the Microsoft fourth quarter earnings call. After a period of uncertainty about how strategic Dynamics was as Microsoft partnered with Salesforce.com and apparently considered buying the company, the message from the top is that Dynamics still matters.

***

"With Azure and the Azure stack, we now provide a consistent hybrid cloud platform that can be used to run any workload, whether it's Windows Server or Linux. With our new Operation Management Suite, you can now manage those workloads no matter where they run, whether it's on-premises in an existing customer datacenter, in a service provider datacenter or in our public cloud."

"With Azure and the Azure stack, we now provide a consistent hybrid cloud platform that can be used to run any workload, whether it's Windows Server or Linux. With our new Operation Management Suite, you can now manage those workloads no matter where they run, whether it's on-premises in an existing customer datacenter, in a service provider datacenter or in our public cloud."

--Scott Guthrie, Microsoft Cloud and Enterprise Group

As he worked his way through a long list of Microsoft cloud services intended to illustrate how uniquely thorough a set of offerings Microsoft has, Guthrie mentioned what might have been a jarring word in any other year: "Linux." But Linux and other open source workloads were stars of the 2015 WPC. Microsoft had an open source pavilion in the expo center and recognized open source partner award winners.

***

"In our commercial business we continue to transform the product mix to annuity cloud solutions and now have 75,000 partners transacting in our cloud. We are also expanding the opportunity for more partners to sell Surface, and in the coming months will go from over 150 to more than 4,500 resellers globally."

"In our commercial business we continue to transform the product mix to annuity cloud solutions and now have 75,000 partners transacting in our cloud. We are also expanding the opportunity for more partners to sell Surface, and in the coming months will go from over 150 to more than 4,500 resellers globally."

--Kevin Turner, CTO

This quote is actually a cheat. It didn't come from the WPC. Turner issued the statement a few days later for Microsoft's fourth quarter earnings statement. In some ways it's more significant than anything Turner said in his WPC keynote, which was the usual mix of fiery exhortations to partners to sell more Microsoft products and digs against Microsoft's competition.

The quote above was a rare mention of the channel in an earnings release, suggesting that Microsoft's push via CSP to get partners more involved in cloud sales is strategic enough to mention to investors.

Turner also provided specific numbers for how many resellers will be brought into the new, much broader Surface reseller program. It's about 30 times as many partners.

***

"We are re-orienting all our cloud competencies and our partner incentives to be based on active usage as opposed to the sale, which is an incredible shift."

"We are re-orienting all our cloud competencies and our partner incentives to be based on active usage as opposed to the sale, which is an incredible shift."

--John Case

Active usage, a.k.a. consumption, is a key term for partners in Microsoft's FY16. New dashboards on the MPN portal will show it. Account managers will track it. Incentives will pay based on it. Microsoft is under enormous pressure to convert many of the cloud seats that were bundled into Enterprise Agreements and other licensing arrangements into a vital part of customers' businesses, so that those same customers don't cancel the services. That pressure is being transferred to partners and will get more intense as the fiscal year progresses.

Posted by Scott Bekker on July 23, 20150 comments

Microsoft partners focused on Dynamics have grown accustomed to seeing their product set play second fiddle to the flashier parts of Microsoft's product portfolio -- Office 365, Azure, Surface -- come earnings season.

This year was different. In the year-end earnings call on Tuesday, Microsoft CEO Satya Nadella and CFO Amy Hood bragged on Dynamics so many times in their prepared comments that analysts' ears perked up and they started asking questions.

Talking about his three broad ambitions for Microsoft, Nadella said, "Let me start with reinventing productivity in business processes, including our efforts across Office 365 and Dynamics."

Calling CRM a $20 billion-plus market with a "massive opportunity for reinvention," Nadella said, "Mainstreaming Dynamics into our engineering sales and marketing efforts gives us the ability to participate in this large and growing market in a more meaningful way."

He went on to discuss the acquisition last week of FieldOne Systems to strengthen the Dynamics CRM customer service offering and a 140 percent jump in total paid Dynamics CRM Online seats for the fourth quarter.

"We have more than 8 million paid Dynamics seats across CRM and ERP in total, up 25 percent year over year. This creates a great foundation for future growth in our Dynamics business," Nadella said. Later in the call, he said the Dynamics business was greater than $2 billion in FY 2015.

Added Hood in her prepared remarks, "Dynamics revenue grew 15 percent on a constant currency basis, driven by the strong CRM results Satya talked about and our ERP business, which saw 35 percent growth in customers this quarter."

All that led Walter Pritchard of Citigroup to say during the Q&A, "Satya, you mentioned CRM in your comments, your prepared comments, which we haven't really heard you talk that much about as an area of interest in the past. I'm wondering what changed in your view, or how do you look to bring that into, it sounds like, more the core productivity scenario that you deliver?"

In his response, Nadella noted the shifting category boundaries among collaboration, communications and business process and acknowledged his own efforts in opening up Microsoft to the 800-lb gorilla of the CRM market, Salesforce.com.

But Nadella went on to talk about the unique value Microsoft brings with its own CRM and ERP products. "One of the things that I'm very explicit about is we will have an open platform for other business process applications because it's a very fragmented market the world over, especially if you add SMB. And so we want to be having a platform play, as well as our own business applications play, and both of them should be high-growth for us. And in the last year, we just added more focus and we put more selling capacity around it, more marketing capacity, and now for the mainstream that's across Microsoft because I'm a big believer in this because I think we have something unique to add. As opposed to driving our own top-line/bottom-line growth, I think we can bring real innovation, and that's what is exciting to see. And it's not just CRM. I'm actually excited about our ERP business," Nadella said, according to a Seeking Alpha transcript.

The Dynamics seats are key to some of Microsoft's other ambitions. "When I think about data as the new currency, we have lots of managed seats and a lot of data which all will move to the cloud. And so things like Power BI and Cortana Analytics can help customers transform. So in fact, that's one of the reasons why we have been very optimistic about some of our new data capabilities because we have the attach capability go out even in the install base of Dynamics," Nadella said.

Another analyst, Heather Bellini of Goldman Sachs, asked how Microsoft could compete with "the big SaaS incumbent," presumably Salesforce.com, and whether Microsoft has the assets internally to execute against its long-term goals.

Nadella answered by developing the opportunity-in-fragmentation theme. "I think people like to talk about leaders, and there are clearly leaders when you go to the very top of the enterprise customers and segments. But the way the market splits into verticals and into horizontals and then the platform affects it, there's plenty of opportunity. For sure, you've got to be one of the players. It will be three players, four players, whatever, but in every technology paradigm, you want to be one of them," Nadella said. "So that's my bullishness on our business process prospects."

Jeffrey Goldstein, managing director of New York-based Dynamics partner Queue Associates, said he was very pleasantly surprised by all the Dynamics mentions and financial details when he read through the earnings transcript early Wednesday morning.

"It was good," Goldstein said in a telephone interview. "In the past, we've always asked what the revenue is for Dynamics. Was it growing? They've said that's confidential. This is the very first time we're seeing it broken out specifically."

The Dynamics focus in the earnings call follows a Microsoft Worldwide Partner Conference (WPC) last week in Orlando when Dynamics also took center stage. "This was kind of reinforcement of what we heard at WPC. The messaging at the Worldwide Partner Conference was excellent. Not only Satya, but [COO] Kevin Turner and every one of the keynotes mentioned Dynamics and how it's critical to their overall cloud strategy. That made us feel good and really gave us confidence," Goldstein said.

The status of Dynamics within Microsoft had become uncertain for partners, first with the rumors that Microsoft had considered acquiring Salesforce.com, followed by the June reorganization that saw longtime Dynamics executive Kirill Tatarinov leave the company and shifted the Dynamics business unit into the Cloud and Enterprise Group.

For now, questions of whether Dynamics might get lost in the larger cloud division have been put to rest.

"Satya, coming out of the Dynamics practice and having managed CRM, he understands how it can be leveraged and how it reinforces their strategy," Goldstein said.

Posted by Scott Bekker on July 22, 20150 comments

Microsoft CEO Satya Nadella spent part of his earnings call this week explaining some of Microsoft's recent restructuring moves as a way to align the company with the biggest opportunities.

"We pushed forward in our transformation by focusing our investment in areas where we have differentiation and significant opportunity for future growth in large addressable markets," Nadella said during the call.

So what are those big opportunities? Nadella put dollar figures on four of them, totaling $115 billion.

- E5, the new SKU of Office 365, which takes the top-selling E3 SKU and adds cloud PBX, PSTN conferencing, Delve analytics, Power BI Pro, Lockbox and advanced threat protection. "With E5, we have expanded our market opportunity for Office 365 by more than $50 billion," Nadella said, using a figure in the ballpark of what Microsoft executives told partners a week ago at the Microsoft Worldwide Partner Conference. "This new E5 SKU and the launch of Office 2016 will drive one of the biggest new businesses for us."

- CRM. Nadella called CRM a $20-billion market with "massive opportunity for reinvention."

- BI and analytics. "Business intelligence and analytics is another large, rapidly growing market for us with an opportunity of more than $15 billion," Nadella said.

- Security. Calling security "a key priority for our enterprise customers," Nadella used a figure of $30 billion for that market opportunity.

One other area -- although Nadella didn't attach a specific dollar figure to the opportunity -- was Windows 10. He vowed that Windows 10 would broaden the economic opportunity for Microsoft and the PC ecosystem and return Windows to growth.

Posted by Scott Bekker on July 22, 20150 comments

After a three-month search, Microsoft this week named Oracle veteran Stephen Boyle to run the U.S. channel for Microsoft, replacing Jenni Flinders.

Boyle's formal title is vice president of U.S. Partner Strategy and Programs. He reports to David Willis, corporate vice president of Microsoft U.S. Small and Midmarket Solutions & Partners (SMS&P), who announced the appointment in a blog post Tuesday.

"This announcement is the culmination of an exhaustive search for the right leader, and I know Stephen will play a key role in leading across Microsoft U.S. to transform how we scale our business together with partners. Stephen's role is a critical one for the organization and the company, as he will serve as our U.S. 'Channel Chief,' supporting our vast U.S. partner ecosystem," Willis said.

Boyle has been at Microsoft for just over a year, most recently reporting to Susan Hauser as a vice president in the Enterprise Partner Group. Before coming to Microsoft, he was group vice president for ISV and OEM sales at Oracle, one of a number of senior leadership roles he held at Oracle since 2005, according to his LinkedIn profile. Boyle also lists Sun Microsystems and Data General among the places he's worked in a 25-year tech career.

In a statement for Willis' blog post, Boyle kept his comments to Microsoft's current big themes: "I'm very excited to join U.S. SMS&P as the new U.S. Channel Chief. I'm looking forward to working closely with many of you and accelerating partner transformation in this mobile-first, cloud-first world. I believe we must enable and engage with all of our partners to help you build compelling industry and business solutions for our joint customers. The cloud creates new opportunities for all of us."

Flinders left Microsoft in April after more than 14 years with the company, much of it in high-profile partner-facing roles in the U.S. Partner Group and the Worldwide Partner Group. She ran the U.S. partner channel from 2009 onward.

Posted by Scott Bekker on July 16, 20150 comments

- Get more WPC 2015 news here.

Microsoft will accelerate the ongoing shift of its partner incentives to increase the focus on cloud-related business activity in fiscal year 2016, which started at the beginning of this month.

Partner incentives are one of Microsoft's biggest levers for aligning partner behavior with company goals. One of the company's biggest stated goals this year is getting more partners to do more business in the cloud.

Microsoft COO Kevin Turner told partners in his Microsoft Worldwide Partner Conference (WPC) keynote on Wednesday that Microsoft wants to "own" the cloud, given the company's unique positioning in both consumer and business service offerings that span IaaS, PaaS, SaaS and hybrid cloud.

Despite a count of 75,000 partners transacting cloud business with Microsoft in FY15, Turner said, "We don't have enough cloud partners at scale in the company today."

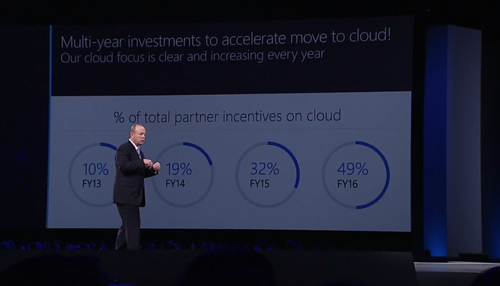

Turner said nearly half of Microsoft's total partner incentives for fiscal year 2016 will go for cloud-related work. In a slide (see below), Turner showed the steady upward march of that percentage starting with 2013.

[Click on image for larger view.]

[Click on image for larger view.]

As a percentage of total partner incentives, cloud incentives accounted for 10 percent in 2013, 19 percent in 2014 and 32 percent in 2015. For fiscal year 2016, that figure jumps to 49 percent, which is the biggest percentage-point increase over the entire period. The overall size of the partner incentive pool was not shared in the keynote.

The focus on cloud incentives accompanies another major change Microsoft is making to encourage partner participation in cloud this year. The other is the broad market rollout of the Cloud Solution Provider (CSP) program (see RCP's July cover story for details.) That program allows partners to both bill their own customers directly and to bill them on a monthly, rather than annual, basis.

In an interview, John Case, corporate vice president for Office marketing, said Microsoft expects the broad rollout of the CSP program to radically expand the number of partners transacting cloud business with Microsoft this year.

More from WPC 2015:

Posted by Scott Bekker on July 15, 20150 comments

- Get more WPC 2015 news here.

Microsoft will roll out a new premium Office 365 enterprise suite later this year called E5 that company executives are positioning as the new flagship offering of the cloud productivity suite.

E5 will bring several brand-new capabilities to the Office 365 suite, including Cloud PBX, analytics, Power BI and advanced security capabilities. John Case, corporate vice president of Office Marketing for Microsoft, introduced the suite in a Microsoft Worldwide Partner Conference (WPC) keynote speech Monday.

"We think what that does is more than double the available market for Office 365," Case said in an interview after the keynote. "The number that I put on the slide today was a $56 billion addressable market. We think we're less than half that today with services like e-mail and the Office client."

Case said the suite would be available later in the calendar year. Pricing will be announced closer to general availability of the suite, but Case contended that it would be compelling.

"We will price it aggressively relative to all the individual components. People will look at it and they think, Power BI, we've priced it as $10 per user. For Advanced Threat Protection and things like Lockbox, other providers are charging a significant amount of money for those services on a standalone basis. Cisco's price points on things like WebEx are significant. Those aren't free services. So when you add all that up, we'll be able to give a significant advantage to those that buy from one vendor for something like E5," Case said.

Currently, the largest percentage of Office 365 sales come under the E3 SKU, which includes most of the high-end server functionality, plus the Office client software.

"I think a very sizable percentage of the Office 365 customer base will find E5 very attractive from a price perspective and an end-to-end functionality perspective," Case said. "It won't be 100 percent, but it will be a sizable percentage."

Case said the whole suite will provide new opportunities for all Office 365 partners, but integration of the new PSTN conferencing capabilities and Cloud PBX with existing enterprise telephony infrastructure opens opportunities for large telco partners.

More from WPC 2015:

Posted by Scott Bekker on July 14, 20150 comments

Every year, Redmond Channel Partner magazine and Revenue Rocket Consulting Group scour the Microsoft partner community for IT services companies that are doing it right. We look for companies with great business strategies that result in sustained growth.

Today we're pleased to announce the three winners of our third annual award: Pariveda Solutions, Uptime Legal Systems and Valorem Consulting.

"We are particularly excited about the slate of RCP/Rocket award winners this year. They are a diverse set of partners that represent the 'best of the best' of the Microsoft channel. They have set a very high standard indeed for others to follow," says Mike Harvath, president and CEO of Revenue Rocket, an RCP columnist and a member of the award selection panel.

The award recognizes the companies for their innovative business strategies that resulted in sustained growth over a three-year period, from 2012 through 2014.

The award sought applications from U.S.-based IT services firms with annual revenues between $5 and $75 million.

Stay tuned for the October issue of RCP when we'll profile the winners and tell their inspiring growth stories.

Posted by Scott Bekker on July 13, 20150 comments

Fred Voccola admits that he's "drinking out of the firehose right now" in his first week as the new CEO of Kaseya, one of the prime mover companies in the remote monitoring and management (RMM) tools market for managed service providers (MSPs). But Voccola took a few minutes to speak with RCP about his plans for the company.

Here are some highlights of the conversation, which has been lightly edited for clarity.

What are your plans for the company?

It's day three, so ask me in a few weeks. But the premise of coming on board and one of the things that turned me on about Kaseya is that Kaseya was one of the founding thought leaders of the MSP community. It's a great market. It's a market that's only going to grow substantially. As the demographics and dynamics of MSPs grow, this is a really exciting place to be. Kaseya has a great team.

I think the communication with the community is going to change. The primary focal point that we are going to have in this business from an operational standpoint is the single goal of having our partners and customers have the best experience in working with Kaseya.

[We'll focus on making the products] easy to use, powerful and scalable. We want customers to want to use the product. As a business, we need to be very easy to commercially interact with. It has to be a great experience to work with us -- business terms, customer terms, legal terms. Our commitment is to making the customer successful and being proactive in helping them do that.

"Kaseya is not a business where we need to sell it to a platform company. I see an IPO as a higher probability than a sale."

"Kaseya is not a business where we need to sell it to a platform company. I see an IPO as a higher probability than a sale."

Fred Voccola, CEO, Kaseya

What should MSPs expect from Kaseya during your tenure?

From a product perspective in the coming weeks, there will be some pretty interesting announcements. Kaseya in the last 18-20 months has spent well north of $31 million in R&D in enhancing and developing our platforms. We're really excited to start communicating and rolling that out both for the MSPs, as well as midmarket IT.

Our customer base is 70-80 percent MSPs. What MSPs can expect in the next 60 days is they will notice a substantial advancement from where the industry is to what we deliver from a customer-success perspective. We're going to have incredible strides industrywide there. I think within 60 days it will hit the market in an incredible way.

In the past, you've come into companies and generated high growth and then a sale. Are you being brought in to prepare the company for a sale?

Hopefully, we get the high growth. Selling a company is never the objective. That's the path that was right for [some of] those companies for various reasons. At Nolio, I was brought in; now it's under CA, and doing very well at CA, by the way. Nolio was kind of the first player in the DevOps space doing release optimization. In that world, it's very difficult for a vendor to stay independent. Here at Kaseya, we have a platform. Kaseya is not a business where we need to sell it to a platform company. I see an IPO as a higher probability than a sale. If you look at the financial dynamics of Kaseya, it's easier for us to aggregate [other technologies into our platform]. As for the timing on an IPO, I have no idea.

Kaseya has acquired at least four companies or technologies over the last few years. Do you plan to continue with acquisitions?

Whether it's build or buy, we have a very robust and capable dev team and product organization. The world's going to see a lot of the fruits of what we've been building. We are looking to expand organically and inorganically. Looking at acquisitions is always an ongoing thing in a business like Kaseya's.

Kaseya has shifted a lot of product development to the cloud, although many users continue to run the on-premise versions. Will you continue to support on-premise versions?

One hundred percent yes. We are in the business of making our customers successful. Some of our customers leverage an on-premise solution. Some customers prefer a cloud delivery model, and obviously we're going in that direction, as well. Cloud delivery is not the best solution for every customer. We're innovating on our entire platform.

What should Kaseya's MSP partners know about you?

This is not really about me but about the organizations I've been lucky enough to be a part of. I've been so blessed in my career where I'd love to say it's all been by design. I've worked with some absolutely phenomenal, amazing people. The one consistent thing I've learned from people who have been my mentors, peers, employees, all through my career is business is very simple. Have a product that makes your customer absolutely love it and love working with you. Everything else, the revenue, the profitability, all of that stuff takes care of itself.

Related:

Posted by Scott Bekker on July 09, 20150 comments